Lazada’s Seller-Funded Instalment Payment Plan (IPP): A Smarter Way to Offer Instalments

Erra 18 Jun 2025 08:06ENCopy link & title

Offering instalment payments is one of the most effective ways to attract high-value buyers, especially for big-ticket items. With the Seller-Funded Instalment Payment Plan (IPP), you can give your customers the flexibility to pay in monthly instalments using their credit card, without them bearing any extra interest.

In this guide, we’ll cover things you need to know about the Seller-Funded IPP on Lazada, from eligibility to costs, setup, and customer visibility.

What is Lazada Seller-Funded IPP?

Seller-Funded IPP is a feature on Lazada that lets buyers use their credit card to pay in instalments, like over 3, 6, or 12 months. The buyer doesn't pay any extra interest instead, the seller pays the interest cost to the bank.

So from the customer’s perspective, it’s a 0% instalment plan, making expensive items more affordable. Meanwhile, the seller still receives the full payment upfront (after deducting some bank fees). This setup helps increase sales, especially for higher-priced products.

Who Can Join Lazada Seller-Funded IPP?

Any Lazada seller can join the Seller-Funded IPP program, as long as they accept the official terms and conditions. If you’re joining for the first time, you must:

1. Download and sign the agreement from the Admin Seller Center (ASC).

2. Upload the signed document when applying.

Once approved, your products will be available for instalment payments using both Maybank and CIMB credit cards. You cannot choose to offer only one, both banks are included by default.

What Banks and Instalment Options Are Available?

As of November 2024, only Maybank and CIMB credit cards can be used for instalment payments under the Seller-Funded IPP program. Each bank offers different options for how long customers can spread out their payments:

-

Maybank: 6, 12, 18, 24, or 36 months

- CIMB: 3, 6, 12, 24, or 36 months

If you join the Seller-Funded IPP program, you're responsible for paying the interest fees charged by the bank. The total cost depends on:

-

Which instalment plan (tenure) the customer chooses

-

Which bank (Maybank or CIMB) the customer uses

-

An additional 6% SST (Sales & Service Tax) on top of the fee

These charges are deducted from your account every week and can be found in your Account Statement under the label “Instalment Fee.”

If the customer returns the item within 14 days, Lazada will refund the IPP fee back to you.

Which Products Are Eligible?

Only certain products can be offered with instalment payments under the IPP program. You’re allowed to enable IPP only for:

-

Brand-new physical products

-

Items that cost RM500 or more (after all discounts)

You cannot enable IPP for:

-

Digital goods (e.g. software, e-vouchers)

-

Used or refurbished products

-

Products that fall under Lazada’s prohibited categories

Also, before the instalment option appears to buyers, you must manually whitelist the eligible SKUs (product listings) through Lazada’s system.

How to Enable IPP for Your Products

To offer instalment payments (IPP) for your products, you need to enable it manually in your Lazada Seller Center. You can do this in two ways:

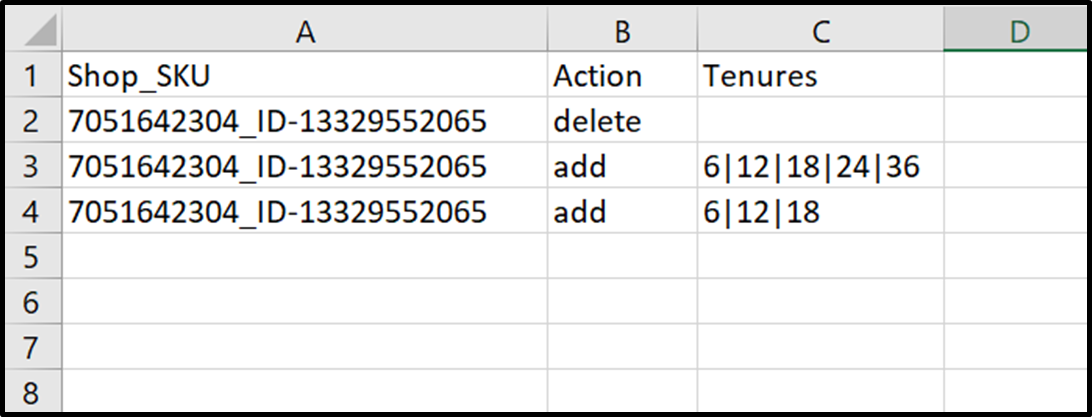

1. Mass Upload - Good for many products:

-

Download Lazada’s CSV file template.

-

Fill in your product SKUs, select instalment durations (tenure), and choose whether you want to add or remove them.

-

Upload the file back to the system.

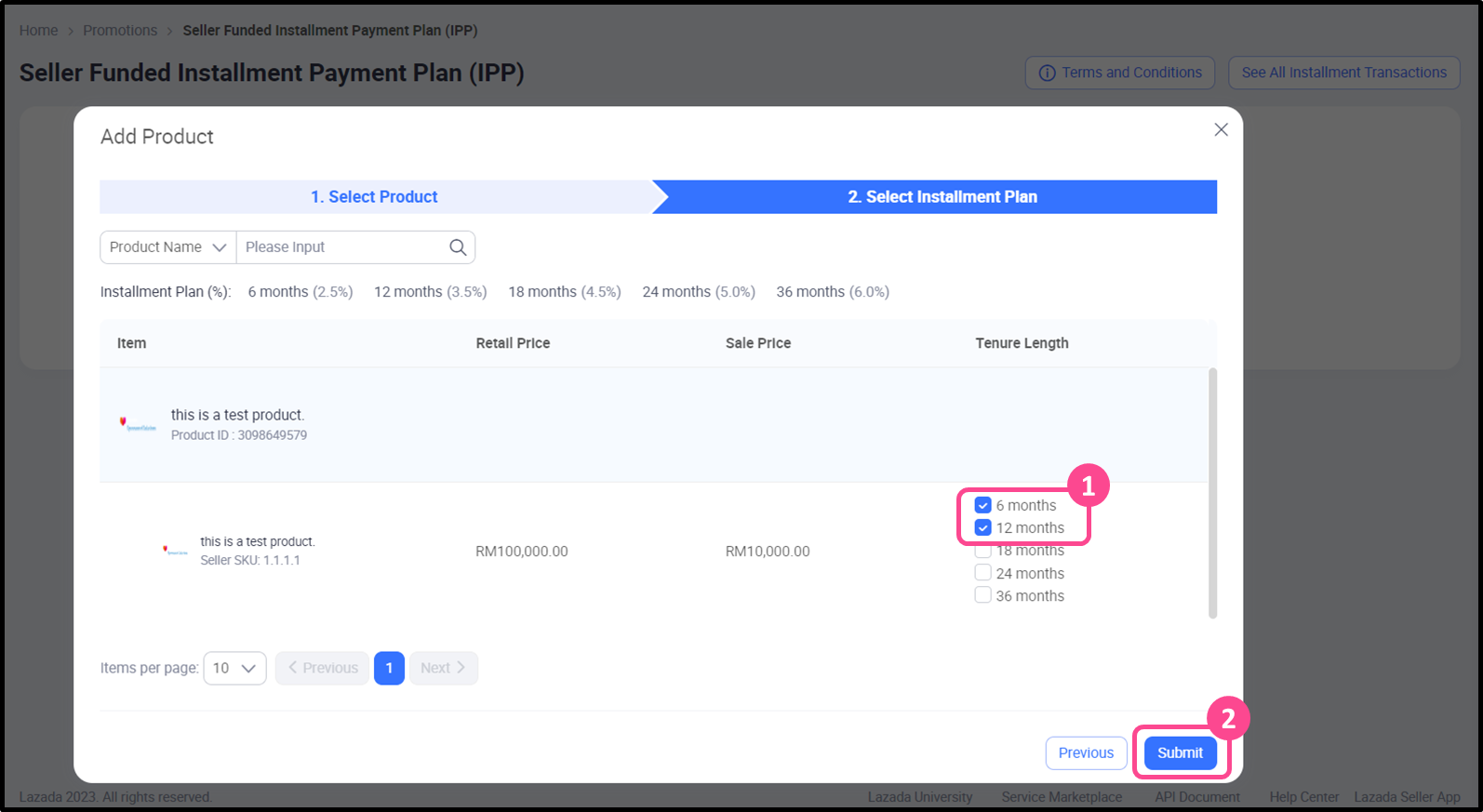

2. Single Product Upload - For just a few products:

-

Manually select the SKUs you want.

-

Choose the instalment options and apply the changes.

Important for LazMall Retail sellers: You cannot enable or remove SKUs directly. You must submit your request using Lazada’s online form and Excel file instead.

Customisation and SKU Control

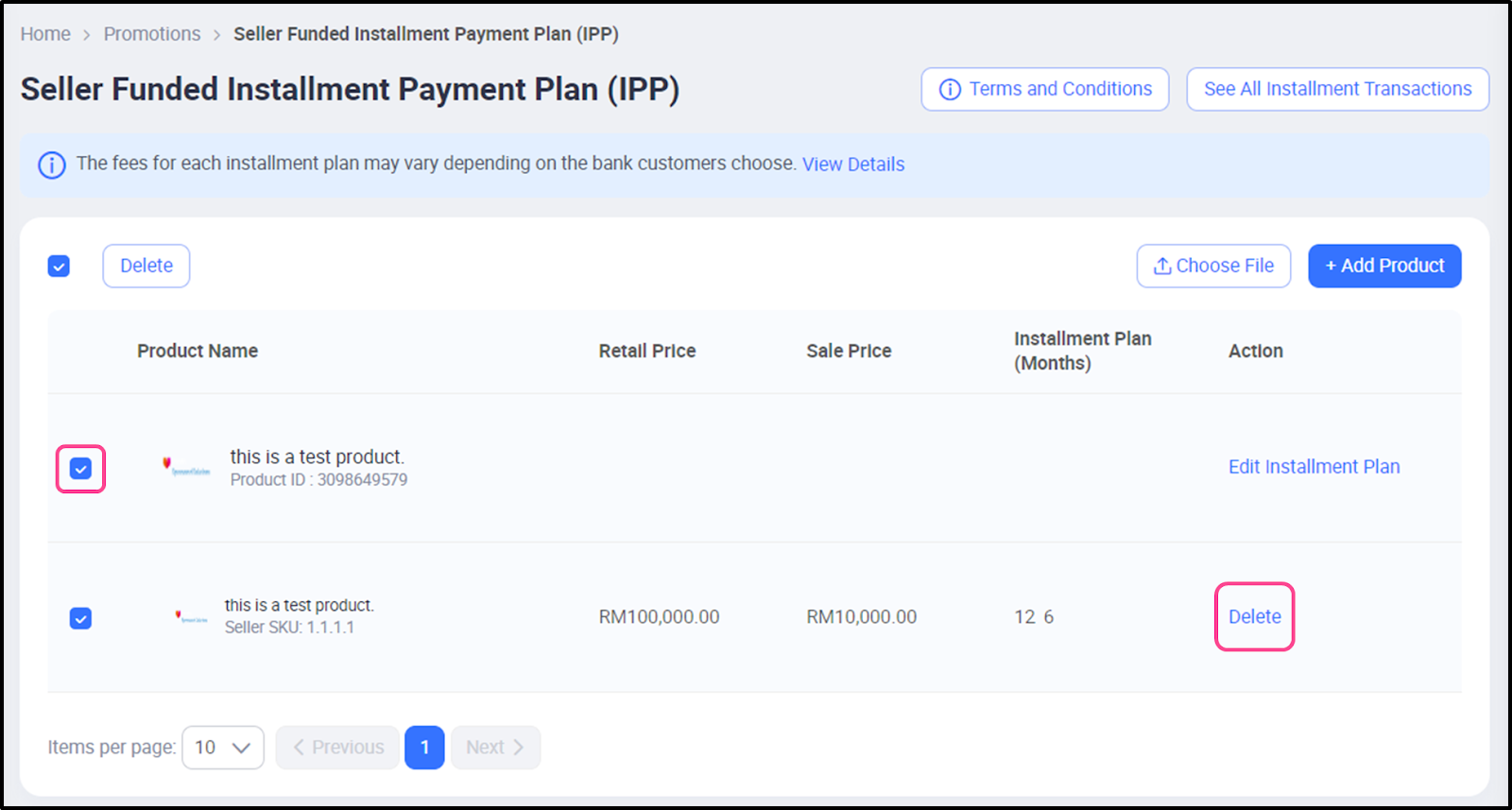

As a seller, you have full control over how you use the IPP program. You can:

-

Decide which products you want to offer instalment payments on

-

Select specific instalment durations (e.g., only 6 or 12 months) for each product

-

Add or remove products (SKUs) from the IPP list whenever you want, as long as you keep it between 1 and 1000 SKUs

Lazada will process any changes every Monday and Thursday, and the updates will go live on the next working day.

How Will Customers Know?

When you enable IPP for a product, buyers will see the instalment payment option clearly displayed on the product page under the “Instalment” section. This helps customers easily identify which items they can pay for in monthly instalments, making it more likely they'll complete the purchase.

Use Lazada’s Seller-Funded IPP Efficiently with BigSeller

Offering instalment payments on Lazada can help you close more sales, especially for higher-priced products, but managing it manually can get tedious if you have a large catalog.

With BigSeller’s centralised product management, you can easily track and organise your Lazada listings, including those enabled for IPP. Whether you’re handling large SKU volumes or syncing listings across multiple marketplaces, BigSeller helps you maintain product accuracy, monitor pricing, and manage stock efficiently, so your IPP-enabled products are always up to date and ready to sell.

Try BigSeller for free today and see how much time you can save.

Follow our WhatsApp Channel for more e-commerce selling tips and updates.